Within the dynamic environment of the real estate investment industry, Vela Bay has come out as an attractive proposition. It attracts both local and foreign investors to have a presence in the high-growth property markets. This is a development that offers the benefit of the city connection with the life benefits of a condominium as a private development in Bayshore, Singapore. The said development is also included in its portfolio of long-term strategies.

The location of Vela Bay in a redeveloping neighborhood of the East Coast of Singapore gives a subtle narrative of the appreciation of capital, population demand, and macro-economic durability. These factors must be taken into account by financial investors.

The Importance of Real Estate in Bayshore

The Singapore real estate market has traditionally recorded high capital stability and growth. This market has been fuelled by political stability, clear property laws and the long-term demand by both affluent home owners and expatriates. This environment brings residential property, particularly in strategic areas, an attractive diversifier in wider investment portfolios. Specifically, Bayshore precinct is a place of interest since there are new infrastructure developments and closeness to numerous transport locations and lifestyle choice anchors.

The Vela Bay is the first new condominium in this precinct in decades, making the Bayshore no longer a quieter residential enclave. But it is a modern neighborhood with direct connectivity to the Singaporean rail network via Bayshore MRT.

The Vela Bay Strategic Value Proposition

The attractiveness of Vela Bay as not only a luxurious house is supported by a number of economic factors that allow it to be a profitable investment asset with prospects for the future.

Accessibility and Connectedness

Transportation access is one of the greatest factors in property value growth. Vela Bay has the advantage of being connected directly to the Bayshore MRT station. It is part of the Thomson-East Coast Lines that offer good access to the central business district of Singapore, business and entertainment hubs, and the main lifestyle locations. Such connectivity has been essential to both residents and tenants alike. This transportation shortens the commute time and increases rental appeal.

Location Amenities that Affect Value

The lifestyle value is progressively impacting the preference for property among professionals and families. The future of the precinct also contributes to the popularity of Vela Bay as a residential and investment property. This is in terms of the development of more retail, F&B, and community facilities.

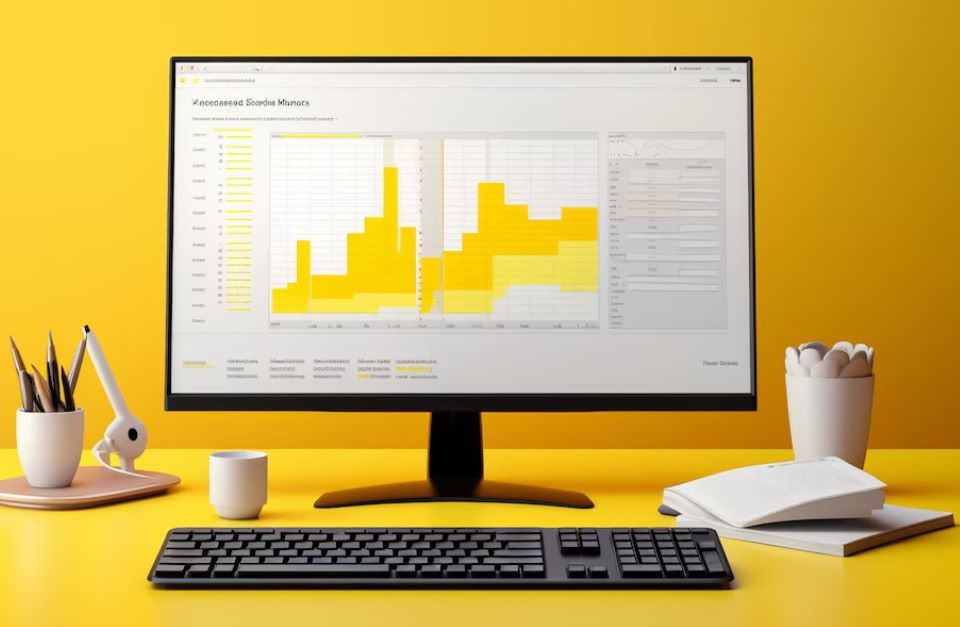

Demonstrators of Capital Growth and Demand

Performance in the real estate market in Singapore is normally dependent on supply and demand, population growth and the urban structures. The residential development land is limited, and areas such as Vela Bay are still undergoing redevelopment in prime lands. Yet, the properties have an added advantage of scarcity value and long-term demand. It applies to both end-user-oriented and yield-oriented owners.

The investors need to observe that the private condominiums tend to outperform the more isolated assets in the past. Credits should be given to its location close to the transport links and lifestyle hubs. This, coupled with the long-term precinct master plan of Bayshore, places Vela Bay in a good position to attract short-term rentals as well as long-term capital growth.

Risk Issues and Prospect

Like in any significant investment, the possible buyers and fund managers need to consider some of the economic factors. It covers the interest rate trends, changes in foreign investment policy, and the overall mood of the market. The Singaporean property regulatory system prevents excessive fluctuations in the market. Yet, due diligence, such as the pricing cycles and rental demand, should be taken into account.

Another factor to consider is the demographic changes. Singapore is becoming an aging nation. Expat workers are entering the market, and the employment sector is also balanced. As a result, it leads to diversified residential demand, especially in the areas of Bayshore with good connectivity.

Economic Ideas: Parallel to Property Investing

The knowledge of the larger economic indicators would help make improved investment decisions about real estate. The ideas of working capital, such as the difference between the current assets and current liabilities, can provide information on the liquidity and financial condition of the business. Further, it can be compared to how the investors may view the acquisition of property costs against the possible cash flow and returns.

Likewise, it is vital that legal and financial planning help to sustain wealth in generations. Wealthy individuals use property assets in holistic estate planning as a tool to protect and increase generational wealth.

Some Key Financial Key Points to Learn

To financial analysts, as it is for property investments such as Vela Bay, real assets may serve a strategic purpose in a diversified portfolio. It is where the drivers of growth (transport infrastructure, lifestyle demand, rezoning) are favorable. Another important thing to know is the transaction costs, holding costs, financing risk, and future yield predicted. Also, the macro trends like interest rates and regulatory changes should be understood.

Improving the Knowledge Foundation

Decision-making is reinforced by extending financial literacy on property and investment. Whether you are comparing real estate with other asset groups or you are planning to diversify your portfolio, combining the property data with the general principles of finance will improve the resiliency of investments and high returns in the long term.

Although a recent World Bank report states that the global economy has become more resilient, for having defied last year’s terrible geopolitical tensions, the latter is still the most serious risk plaguing the world’s

Although a recent World Bank report states that the global economy has become more resilient, for having defied last year’s terrible geopolitical tensions, the latter is still the most serious risk plaguing the world’s  The war between Russia and Ukraine has impacted European

The war between Russia and Ukraine has impacted European  Expert investors give advice that the best investments are the defensive ETFs as they are the safest choices regardless of the condition of the securities market. Albeit investing in defensive Exchange Traded Funds (ETFs) places priority on stability over bold and dynamic profit-yielding strategies, experts find them ideal amidst the current economic conditions.

Expert investors give advice that the best investments are the defensive ETFs as they are the safest choices regardless of the condition of the securities market. Albeit investing in defensive Exchange Traded Funds (ETFs) places priority on stability over bold and dynamic profit-yielding strategies, experts find them ideal amidst the current economic conditions. Categorically, Defensive ETFs fall under the Non-Cyclical Investment Sector. It actually involves investing in mutual funds or ETFs that specifically place funds in recession-proof entities because such businesses are not greatly affected by economic cycles. The stock prices of recession-proof companies generally remain stable under varying phases of an economic cycle.

Categorically, Defensive ETFs fall under the Non-Cyclical Investment Sector. It actually involves investing in mutual funds or ETFs that specifically place funds in recession-proof entities because such businesses are not greatly affected by economic cycles. The stock prices of recession-proof companies generally remain stable under varying phases of an economic cycle.

Bidenomics refers to the Biden-backed economic policies and legislations that Pres. Biden envisioned as support for the post-pandemic recovery goals and in instituting new initiatives. President Biden uses the term Bidenomics to refer to his economic plans of growing the middle class from the bottom up.

Bidenomics refers to the Biden-backed economic policies and legislations that Pres. Biden envisioned as support for the post-pandemic recovery goals and in instituting new initiatives. President Biden uses the term Bidenomics to refer to his economic plans of growing the middle class from the bottom up. In 2021 to 2022, there were more than 10 million applications for the establishment of new small businesses. The periods are on record as the strongest two years of the American economy.

In 2021 to 2022, there were more than 10 million applications for the establishment of new small businesses. The periods are on record as the strongest two years of the American economy.

Crypto arbitrage is a simple concept with a big impact. It means buying a cryptocurrency at a lower price on one exchange and selling it at a higher price on another. The price difference, even if small, creates an opportunity to make a profit. These price gaps occur frequently because there is no centralized price for cryptocurrencies. Each platform sets its own based on supply and demand.

Crypto arbitrage is a simple concept with a big impact. It means buying a cryptocurrency at a lower price on one exchange and selling it at a higher price on another. The price difference, even if small, creates an opportunity to make a profit. These price gaps occur frequently because there is no centralized price for cryptocurrencies. Each platform sets its own based on supply and demand. Wealth brings opportunity, freedom, and the ability to shape your future. But it also comes with complexity. The more you have, the more you need to protect. That’s why legal planning is so essential for high-net-worth individuals. Without the right documents, your wealth and wishes can easily end up in courtrooms, contested by others, or tied up in taxes. Firms like T

Wealth brings opportunity, freedom, and the ability to shape your future. But it also comes with complexity. The more you have, the more you need to protect. That’s why legal planning is so essential for high-net-worth individuals. Without the right documents, your wealth and wishes can easily end up in courtrooms, contested by others, or tied up in taxes. Firms like T

One must understand the basic ideas of blockchain technology before starting blockchain investing. Fundamentally, a blockchain is a distributed, digital ledger kept on several computers that logs transactions. This distributed character guarantees security and integrity of data, therefore resisting fraud and manipulation.

One must understand the basic ideas of blockchain technology before starting blockchain investing. Fundamentally, a blockchain is a distributed, digital ledger kept on several computers that logs transactions. This distributed character guarantees security and integrity of data, therefore resisting fraud and manipulation. A blockchain oracle like Pyth Network is an integral participant in a decentralized ecosystem as it lets crypto blockchain platforms connect to traditional sources of financial data without need for third party involvement. As a database that uses a network of multiple computers dispersed geographically across a wide area, Pyth Network plays an important role in a decentralized financial (DeFi) system.

A blockchain oracle like Pyth Network is an integral participant in a decentralized ecosystem as it lets crypto blockchain platforms connect to traditional sources of financial data without need for third party involvement. As a database that uses a network of multiple computers dispersed geographically across a wide area, Pyth Network plays an important role in a decentralized financial (DeFi) system. g data and completing tasks across a network.

g data and completing tasks across a network. Homeowners in Cumming,Georgia looking to have their front yard redesigned would most likely receive recommendations to get in touch with a barber landscaping contractor. Actually, the barber description refers to Jarrod Barber, the man behind one of the leading landscape

Homeowners in Cumming,Georgia looking to have their front yard redesigned would most likely receive recommendations to get in touch with a barber landscaping contractor. Actually, the barber description refers to Jarrod Barber, the man behind one of the leading landscape  Examples of hardscape structures include simple additions like walkways, fire pits, grill surrounds, sitting walls, landscape lighting and retaining walls. Other hardscape projects are more complex such as patios, water fountains, ornamental fishponds and pergolas

Examples of hardscape structures include simple additions like walkways, fire pits, grill surrounds, sitting walls, landscape lighting and retaining walls. Other hardscape projects are more complex such as patios, water fountains, ornamental fishponds and pergolas

In Florida, if a car accident resulted in severe injuries that cost more than the insurance coverage of the victim’s Personal Injury Protection

In Florida, if a car accident resulted in severe injuries that cost more than the insurance coverage of the victim’s Personal Injury Protection  Actually one of the eligibility criteria that lawsuit loan companies consider when granting a lawsuit funding is the involvement of a reputable personal injury lawyer. The latter will in fact collaborate with the funding company in taking legal action on behalf of the victim.

Actually one of the eligibility criteria that lawsuit loan companies consider when granting a lawsuit funding is the involvement of a reputable personal injury lawyer. The latter will in fact collaborate with the funding company in taking legal action on behalf of the victim.